An inside look at how marketers are introducing convenience, efficiency, and accessibility in the financial services industry by unlocking the potential of digital channels.

Customers have taken a drastic shift to digital in the last few years.

For financial services providers, it means rapid innovation of features and digital experiences to keep up with customers’ changing needs and rising expectations.

For customers, it’s at least one less trip or call to the bank – no more waiting in lines!

Naturally, digital advertising plays a big role in shaping financial services and expanding their reach to digital-first customers.

However, strict privacy regulations, fierce competition, and changing expectations of customers affect the return on ad spend and slow down digital transformation.

As a result, marketers must rethink their strategy and ramp up their presence on digital platforms, enhance customer engagement, and capture data in more innovative ways.

Financial Services Pivot to Digital – Challenges for Marketers

In the extremely competitive world of digital advertising, producing a positive marketing ROI is getting increasingly difficult. It is challenging to generate a favorable return for a variety of reasons.

1. The High Cost of Advertising

As the cost of digital advertising grows on every platform, it becomes more challenging and expensive for financial institutions to attract new customers.

According to Insider, in 2022, Meta’s cost per thousand (CPM) increased by 61% YoY, reaching an average of $17.60. Meanwhile, Google also saw an increase in CPM of 75% YOY on display ads, while search ad cost-per-clicks (CPCs) were up by 14% YOY. 1

As a result, marketers need to find more effective ways to improve conversions and increase their return on ad spend.

According to Insider, in 2022, Meta’s cost per thousand (CPM) increased by 61% YoY, reaching an average of $17.60. Meanwhile, Google also saw an increase in CPM of 75% YOY on display ads, while search ad cost-per-clicks (CPCs) were up by 14% YOY. According to Insider, in 2022, Meta’s cost per thousand (CPM) increased by 61% YoY, reaching an average of $17.60. Meanwhile, Google also saw an increase in CPM of 75% YOY on display ads, while search ad cost-per-clicks (CPCs) were up by 14% YOY.

2. Customers Evolving Expectations from Digital Experiences

The new generation of customers builds trust based on the quality, responsiveness, and consistency of their experience with financial institutions.

Financial jargons are too complex to understand, and customers don’t always know what they want (or what to call it).

In fact, a typical bank website is said to have over 337 web pages and complicated navigation, making it difficult for visitors to find information.

In buying a home, for instance, you need to navigate a maze of lending websites or meet real-estate brokers, lenders, insurers, and other professionals. Consumers seek a trusted expert who simplifies that maze and delivers personalized, distinctive, and advice-focused value instantly.

How are Marketers Using AI-powered Technologies to Overcome These Challenges?

Customers’ behavior and expectations are constantly changing, making it challenging to win their loyalty without offering digital-first experiences. Though, marketers have realized the importance of effective communication on digital channels and are now using AI to create experiences that feel personal and improve conversions.

Target Audience Accurately using First Party Data

Customers are more dubious about how financial institutions utilize their data even though they expect more individualized purchasing experiences.

In fact, preliminary feedback on Apple’s new privacy policy indicates that only 46% of customers will consent to being tracked. This number may even be lower in nations where users are particularly sensitive to privacy. 3

There is a need for brands to collect first-party data more than ever. Customers share this data with consent and expect brands to provide a personalized experience on digital channels.

For instance, a financial institution could use customer data to target users who have an upcoming loan payment, allowing them to make their payment quickly and easily on a customer preferred digital channel.

Using first party data, finance marketers can improve their odds of reaching the right person with the right offer at the right time by using specific data sets. Implementing personalization strategies requires that certainty.

Generate More Leads with Click-to-Message Ads

Let’s say you are running a credit card ad on Instagram. The ad directs prospects to an Instagram DM where you can help them apply for credit cards, they may be interested in without leaving the app.

Financial institutions can leverage multiple messaging channels like Instagram DM to reach customers and improve conversions.

Fortunately, Facebook and Instagram allow businesses to run ads with ‘Click to Message’ CTAs.

Users will be able to have a conversation with a bank without leaving their favorite app, resulting in a more seamless experience.

Financial institutions with effective channel usage, media mix, and messages will generate more quality leads, and increase their revenue through cross selling the right products.

Provide Smart Investment Advice with Assisted Selling

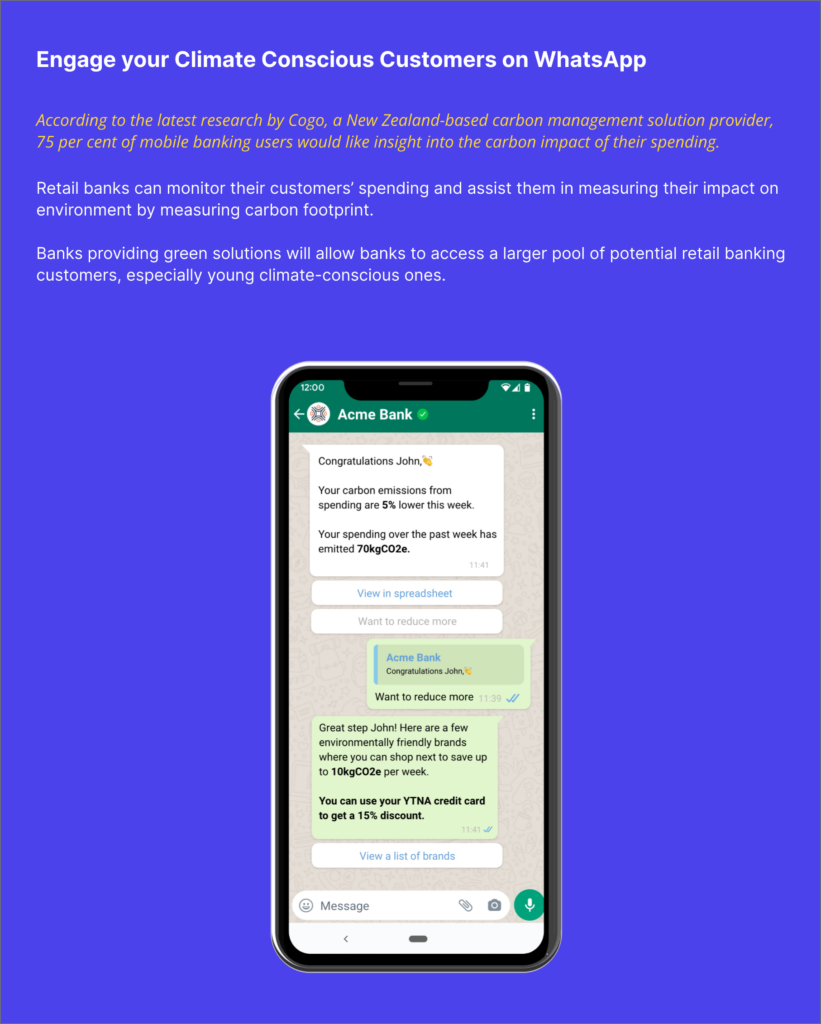

Today, customers not only want to ask about account balance and recent transactions but also looking for trusted advice on investments directly from their bank on messaging apps like WhatsApp.

AI-enabled financial advisors on digital channels will be better equipped to provide market insights to strengthen their client-advisor relationships.

The new generation of customers builds trust based on the quality, responsiveness, and consistency of their experience with financial institutions.

Instead of directing customers to websites, banks must offer complete assistance and advisory services through customers’ preferred channels.

Therefore, virtual assistants are increasingly used on every digital channel to guide customers immediately through the discovery, assessment, and decision phases.

Reshaping the Financial Services Industry with Flyfish – the Digital Sales Platform

Flyfish, the leading Digital Sales platform, enables you to expand your presence on every customer touchpoint, such as WhatsApp, Instagram, Facebook Messenger, and others. It makes it easy for people to find the right product, ask questions, and decide quickly.

The new generation of customers builds trust based on the quality, responsiveness, and consistency of their experience with financial institutions.

Help Buyers Make Right Financial Decision with AI + Human Assisted Selling

Digital sales and servicing are growing rapidly, and digital advisory is gaining more attention, potentially handling 35 percent of complex needs remotely in financial services.

This could translate into a significant increase in efficiency and cost savings, as well as a more personalized experience for customers.

In fact, financial institutions who introduced personal lending services on digital channels have reported 7X growth in sales in just 24 months.

6 Leading banks with exceptional digital experiences have recorded tremendous digital sales growth. However, institutions who are not yet there might lose money and customers as well.

By combining the right technologies and processes, digital channels can provide quick, efficient, and secure service. This will make it easier for customers to see the benefits of doing business with them and improve their loyalty.